India’s financial landscape is rapidly evolving, with Non-Banking Financial Companies (NBFCs) playing an increasingly vital role in delivering credit, loans, and financial services to underserved sectors. Whether you’re a fintech startup, a lending business, or a microfinance entrepreneur, NBFC registration in India offers a powerful gateway to operate legitimately and scale efficiently.

In this blog, we break down the top benefits of registering as an NBFC, and why choosing online NBFC registration in India—with the help of the right experts—can transform your business model.

1. Legitimacy and Regulatory Recognition

One of the biggest advantages of obtaining an NBFC license from RBI in India is credibility. Registered NBFCs operate under the regulations set by the Reserve Bank of India, which gives your business legal standing and builds public trust.

👉 A valid NBFC license in India assures customers, lenders, and investors that your financial operations are ethical and compliant.

2. Wider Scope of Financial Services

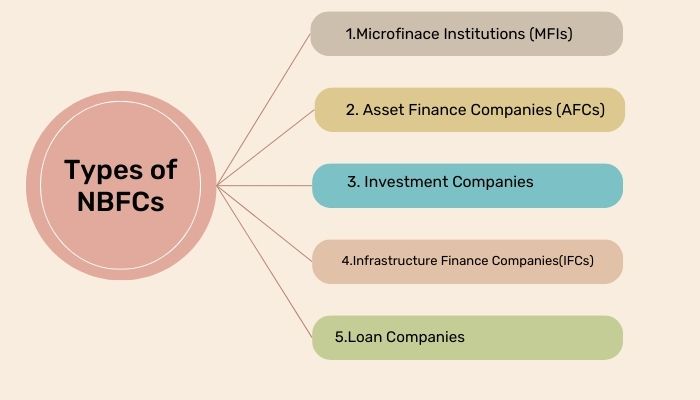

Once registered, NBFCs can legally offer a range of services such as:

- Personal and business loans

- Microfinance

- Vehicle financing

- Investment advisory

- Asset finance

With NBFC registration online, you can unlock the potential to offer multiple credit products, reach rural populations, and cater to niche sectors that traditional banks often overlook.

3. Easier Access to Funding and Investment

Registered NBFCs enjoy higher credibility with banks and financial institutions, making it easier to raise capital. Additionally, private investors and venture capitalists prefer partnering with regulated entities that hold an NBFC license in India.

If you’re looking to scale your lending or fintech platform, acquiring an NBFC license online strengthens your business model and funding opportunities.

4. Faster Time to Market Through Online Registration

Thanks to digital transformation, NBFC registration online in India is now more streamlined than ever. Entrepreneurs can complete most of the registration process remotely with digital document submission and online tracking.

Working with a professional NBFC registration consultant in India ensures accuracy, speeds up the application process, and minimizes compliance errors.

5. Tax Benefits and Financial Autonomy

NBFCs enjoy certain tax benefits and exemptions under specific categories, especially if operating in microfinance or rural sectors. Unlike traditional banks, NBFCs also have more flexible lending norms, which helps in customizing services to target markets.

6. Custom Business Models and Niches

From peer-to-peer lending to leasing and digital payments, NBFCs can choose specialized models that cater to diverse segments. With the flexibility granted under an NBFC license from RBI in India, companies can experiment with innovative financial products that serve both urban and rural India.

7. Expert Guidance and Simplified Compliance

Navigating RBI’s regulatory framework can be complex. A trusted NBFC registration consultant can help with documentation, eligibility checks, business plan formatting, and regulatory filings.

Partnering with a professional NBFC registration consultant in India ensures a hassle-free experience from application to approval.

Final Thoughts

Registering as an NBFC is more than a legal requirement—it’s a strategic move toward legitimacy, scalability, and market expansion. Whether you’re a startup or an established business, obtaining your NBFC license online opens doors to new growth opportunities in the financial sector.

With increasing demand for credit in India’s vast and underserved markets, now is the time to act. Begin your journey with NBFC registration online in India, and consult a professional to avoid delays and ensure compliance.