Financial inclusion—ensuring access to affordable and appropriate financial products and services—is essential for a thriving and equitable economy. In India, where large sections of the population remain unbanked or underbanked, Non-Banking Financial Companies (NBFCs) have emerged as powerful catalysts for change. Their flexibility, reach, and customer-centric models have enabled them to bridge the gaps left by traditional banking institutions.

Understanding NBFCs and Their Role

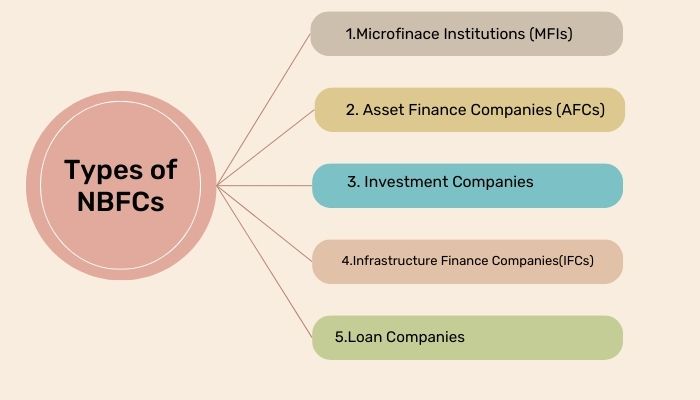

NBFCs are financial institutions that provide banking services without meeting the legal definition of a bank. They play a crucial role in credit distribution, especially to underserved and rural sectors, including small businesses, low-income households, and individuals without formal credit histories.

Some of the key areas where NBFCs contribute to financial inclusion include:

- Microfinance and Rural Lending: NBFCs offer micro-loans to farmers, artisans, and women entrepreneurs who are often denied credit by banks.

- SME Financing: They support small and medium enterprises (SMEs) with working capital loans and business expansion credit.

- Digital Lending and Fintech Innovations: Many NBFCs leverage technology to offer seamless, paperless financial services even in remote areas.

Why NBFC Registration Matters

With growing interest in starting an NBFC, understanding the registration process is crucial. NBFC Registration in India is a regulatory requirement governed by the Reserve Bank of India (RBI). Without proper registration and licensing, an entity cannot legally function as an NBFC.

To operate lawfully and gain public trust, companies must obtain an NBFC License from RBI in India. This ensures regulatory oversight, financial stability, and adherence to compliance norms.

Key Steps for NBFC Registration Online in India

- Company Incorporation: The first step is to incorporate a company under the Companies Act.

- Capital Requirements: Maintain a minimum net owned fund (NOF) of ₹2 crore.

- Application Filing: Apply for NBFC Registration online through the RBI’s COSMOS portal.

- Documentation: Submit financial, management, and business plan documents.

- RBI Review & License Granting: Upon satisfaction, RBI grants the NBFC License online.

Due to the complexity of this process, many firms prefer working with a NBFC Registrbation Consultant in India who can guide them through compliance, document preparation, and smooth communication with the RBI.

The Growing Need for NBFC Registration Consultants

As the financial ecosystem becomes more regulated, having expert support is invaluable. A seasoned NBFC registration consultant ensures your application adheres to RBI norms, increasing the chances of approval. They also help with post-registration compliance and strategy planning.

Whether you’re opting for Online NBFC Registration in India or renewing your license, these consultants can provide critical guidance every step of the way.

The Road Ahead: NBFCs and Inclusive Growth

As India pushes toward a more inclusive economy, NBFCs will continue to play a pivotal role. Their agility, adaptability, and customer-first approach make them ideal vehicles for driving financial access in rural and semi-urban areas.

With the right support—starting from NBFC Registration online to obtaining an NBFC license from RBI in India—new entrants can make a meaningful impact on the nation’s financial inclusion mission.

Conclusion

NBFCs are no longer just alternative lenders—they are strategic partners in India’s journey toward financial empowerment for all. If you’re looking to make a difference while tapping into a growing financial market, now is the time to explore NBFC Registration in India with the help of a trusted NBFC registration consultant.