Alternative Investment Funds (AIFs) have become a preferred investment route for High-Net-Worth Individuals (HNIs), family offices, and institutional investors in India. Unlike traditional investments in stocks or mutual funds, AIFs allow investors to diversify into private equity, venture capital, hedge funds, infrastructure, and debt-based strategies. To maximize returns and manage risks, building a multi-AIF investment strategy by allocating across Category I, Category II, and Category III AIFs is essential.

For fund managers and sponsors, proper structuring begins with Online AIF Registration in India. With regulatory guidance from SEBI, the process of AIF Registration Online in India can be streamlined by engaging an experienced AIF Registration Consultant.

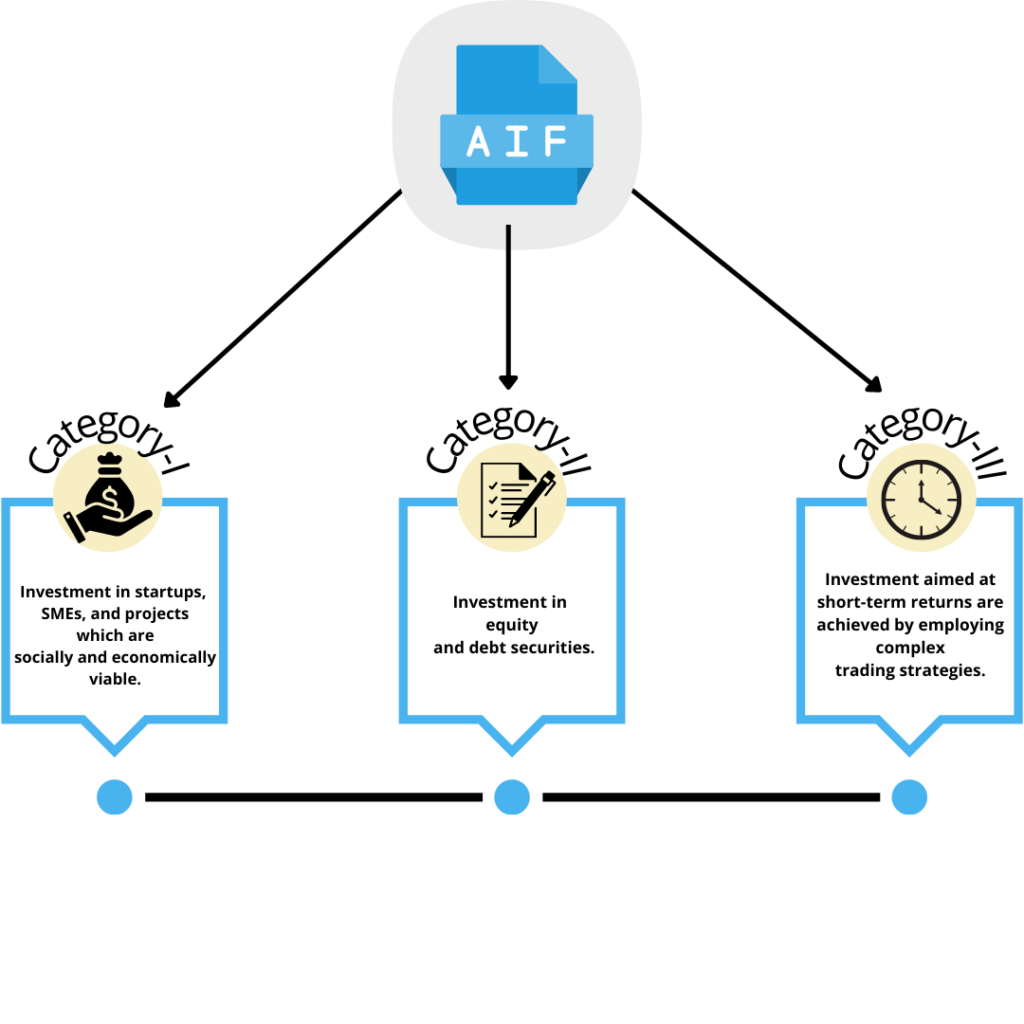

Understanding AIF Categories

Category I AIFs

These focus on investments with positive economic and social impact, such as:

- Startups and early-stage ventures

- Small and medium enterprises (SMEs)

- Infrastructure projects

- Socially impactful sectors

Category I AIFs are ideal for investors with a long-term horizon who seek high-growth potential.

Category II AIFs

This category covers funds such as:

- Private equity funds

- Debt funds

- Fund-of-funds

Category II AIFs offer stable, medium- to long-term returns without leverage or complex strategies. They are suitable for investors looking for balanced exposure between growth and stability.

Category III AIFs

These are hedge fund-style investments using complex trading strategies like:

- Long-short positions

- Arbitrage opportunities

- Derivatives

Category III AIFs are designed for investors seeking shorter-term returns with higher risk tolerance.

Why a Multi-AIF Strategy Matters

Instead of concentrating investments in a single AIF category, diversifying across Categories I, II, and III helps investors:

- Balance Risk and Reward – Growth from Category I, stability from Category II, and market-linked upside from Category III.

- Access Varied Time Horizons – From long-term venture capital plays to short-term hedge fund gains.

- Enhance Liquidity and Flexibility – Since AIFs differ in exit timelines, a blended portfolio offers staggered liquidity.

- Benefit from Regulatory Framework – With structured Alternative Investment Fund Registration in India, investor interests are protected under SEBI regulations.

Suggested Allocation Framework

A practical multi-AIF allocation strategy may look like this (depending on risk profile):

- Conservative Investor:

- 50% Category II (private debt & equity funds)

- 30% Category I (infrastructure/startups)

- 20% Category III (low-risk hedge strategies)

- Balanced Investor:

- 40% Category II

- 30% Category I

- 30% Category III

- Aggressive Investor:

- 30% Category II

- 40% Category I

- 30% Category III (high leverage strategies)

Role of an AIF Registration Consultant

For fund sponsors and managers looking to set up an AIF, navigating SEBI guidelines can be complex. An expert AIF Registration Consultant can help with:

- Drafting the private placement memorandum (PPM)

- Ensuring compliance with SEBI’s framework

- Guiding through Online Alternative Investment Fund Registration in India

- Advising on structuring, taxation, and governance

This ensures a seamless AIF Registration process in India, saving time and reducing compliance risks.

Conclusion

A multi-AIF investment strategy is one of the most effective ways for investors to diversify portfolios, optimize returns, and manage risks. By allocating across Category I, II, and III AIFs, investors can strike the right balance between growth, stability, and liquidity.

Meanwhile, fund managers and sponsors can benefit from expert guidance in AIF Registration Online in India to ensure compliance and smooth operations. Working with an experienced AIF Registration Consultant not only simplifies the Alternative Investment Fund Registration in India process but also provides strategic insights for long-term success.