India is witnessing a paradigm shift in its energy landscape, driven by an ambitious vision to achieve net-zero emissions and become a global hub for renewable energy. At the core of this transformation is the country’s strong push for green hydrogen and other renewable energy initiatives. Interestingly, a crucial yet less visible force fueling this revolution is the growing role of Alternative Investment Funds (AIFs).

With institutional and high-net-worth investors increasingly eyeing green sectors, AIFs are emerging as powerful vehicles to finance sustainable energy projects. But how exactly are AIFs contributing to this clean energy momentum? Let’s explore.

The Green Hydrogen Opportunity in India

India has set a bold target of producing 5 million metric tonnes of green hydrogen by 2030, supported by its National Green Hydrogen Mission. Green hydrogen, produced using renewable energy sources like solar and wind, holds the key to decarbonizing hard-to-abate sectors such as steel, chemicals, and heavy transport.

To realize this vision, massive investments are required in:

- Electrolyzer manufacturing

- Renewable power plants

- Storage & transportation infrastructure

- R&D and pilot projects

This is where Alternative Investment Funds step in.

What Are Alternative Investment Funds (AIFs)?

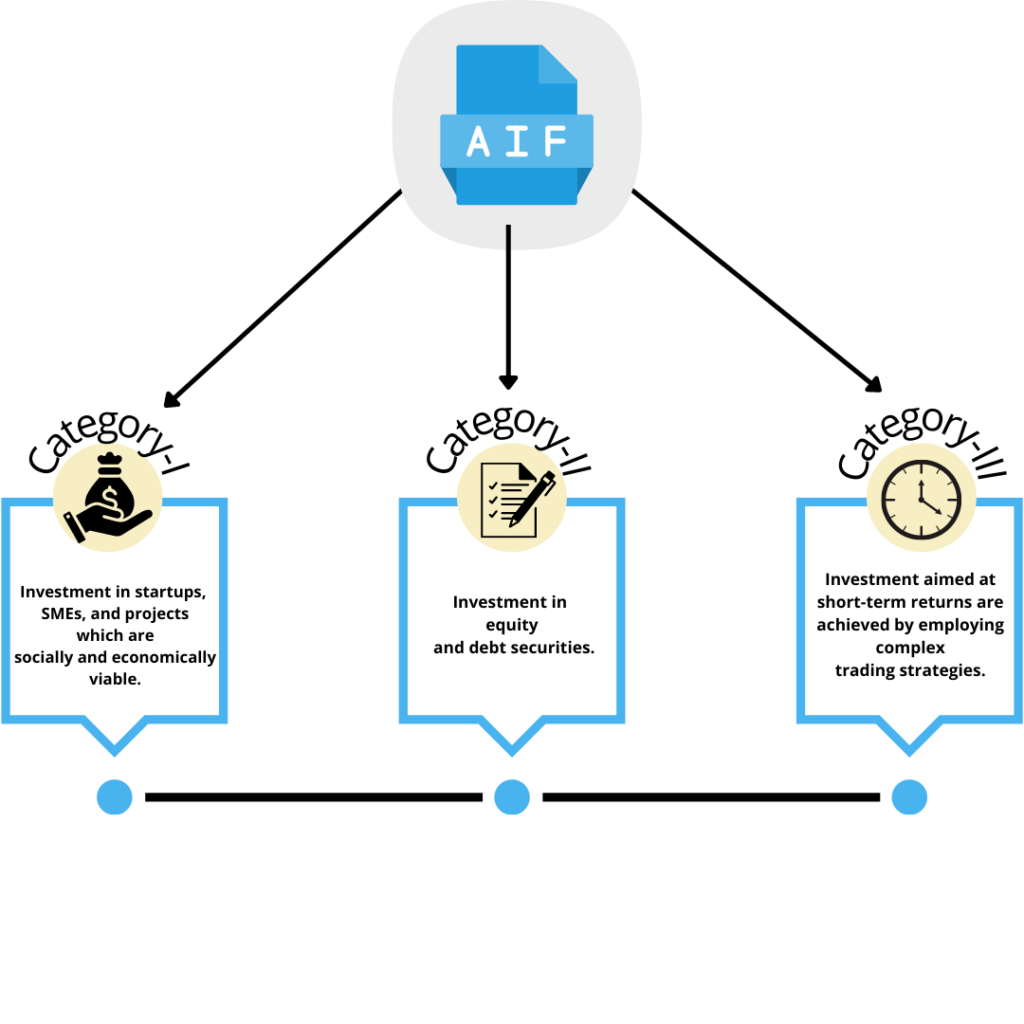

AIFs are privately pooled investment vehicles that collect capital from sophisticated investors to invest in sectors that may not be served by traditional funding routes. These include:

- Infrastructure and green energy

- Venture capital

- Private equity

- Social impact ventures

AIFs are regulated by the Securities and Exchange Board of India (SEBI) and are classified into three categories depending on their risk-return profile and investment objectives.

How AIFs Are Driving Renewable Energy & Green Hydrogen Projects

- Targeted Capital Allocation

Category I and II AIFs are increasingly deploying capital in sustainable infrastructure projects, including solar parks, wind farms, and green hydrogen ventures. This targeted investment is helping early-stage green energy businesses scale up rapidly. - Long-Term Investment Horizon

Renewable energy and green hydrogen projects require patient capital due to their high gestation periods. AIFs are well-suited for such investments, providing long-term funding stability. - Bridging the Financing Gap

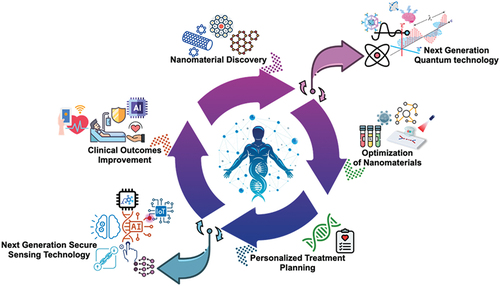

Traditional banks and NBFCs are often risk-averse when it comes to funding emerging technologies. AIFs help bridge this gap by pooling funds from investors who understand and accept the associated risks. - Catalyzing Innovation

AIFs are also backing startups and innovation-led ventures in the cleantech and green hydrogen space, supporting R&D and enabling India to lead the next wave of energy innovation.

Ease of Setting Up AIFs: The Digital Advantage

Thanks to digital initiatives, Online AIF Registration in India has become faster and more streamlined. Entrepreneurs, fund managers, and institutional investors can now opt for AIF Registration Online in India through the SEBI portal, supported by expert consultants.

Some key benefits of online AIF registration:

- Faster processing times

- Simplified compliance

- Digital documentation

- Improved transparency

If you’re considering setting up an AIF focused on renewable energy or green hydrogen, seeking the guidance of an experienced AIF Registration Consultant can ensure seamless compliance and strategic positioning.

Why Now is the Right Time for AIF Investment in Green Sectors

With strong policy support, incentives, and international interest, India’s green hydrogen and renewable energy sectors are poised for exponential growth. Investors who position themselves now through well-structured AIFs stand to benefit from both financial returns and meaningful environmental impact.

Additionally, the regulatory ecosystem is evolving to support innovation-driven capital flows, making this a favorable time for Online Alternative Investment Fund Registration in India.

Conclusion

India’s journey towards a greener, more sustainable future is not just a policy ambition—it is fast becoming an investable reality. Alternative Investment Funds are at the forefront of this transformation, channeling crucial capital into projects that will shape the nation’s energy future.

With digital tools enabling easy Alternative Investment Fund Registration in India, and expert help available through AIF Registration Consultants, there has never been a better time to align investment goals with climate action.