In the ever-evolving world of pharmaceuticals and biotechnology, innovation is the currency of success. As scientific advancements accelerate and health-tech becomes more personalized and data-driven, Alternative Investment Funds (AIFs) are emerging as strategic enablers of growth in this high-risk, high-reward sector. With India becoming a hub for biotech startups and pharma R&D, many forward-thinking investors are turning to Online AIF Registration in India

to access and fund the next major scientific breakthrough.

Why Pharma & Biotech Are Attracting AIF Attention

Pharma and biotech industries are not just about manufacturing generic drugs anymore. Today, they encompass:

- Genomics and gene editing

- mRNA-based vaccines and treatments

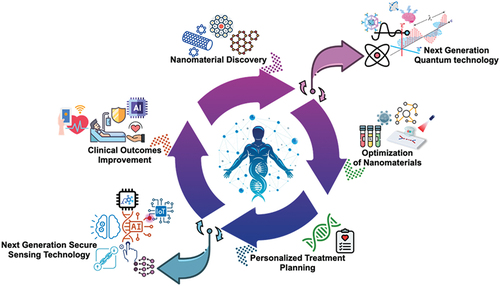

- AI-driven drug discovery

- Personalized medicine

- Immunotherapies and cancer research

These technologies demand significant early-stage funding, making them ideal candidates for AIF investment—especially through Category I and II AIFs, which are designed to channel capital into innovative and socially impactful ventures.

The Role of AIFs in Accelerating Innovation

AIFs serve as a bridge between capital and creativity. In the case of pharma and biotech, AIFs:

- Fund early-stage startups involved in clinical trials, R&D, and regulatory approvals

- Support mid-stage companies scaling their innovations for commercial production

- Enable cross-border collaborations and global tech transfers

- Help mitigate risk through diversified portfolios

With access to expert fund managers and sector-specific insights, investors can bet smartly on technologies that could redefine global healthcare.

How to Get Started: AIF Registration Online in India

Whether you’re a fund manager looking to launch a life-sciences-focused AIF or an investor aiming to participate, the first step is completing the Online Alternative Investment Fund Registration in India through SEBI.

Here’s a simplified breakdown:

- Choose Your Category:

- Category I: For VC funds, SME-focused funds, or social ventures (common for biotech startups).

- Category II: Private equity and debt funds—ideal for late-stage pharma companies.

- Prepare Documentation:

This includes trust deed or LLP agreement, investment strategy, compliance structure, etc. - Engage a Trusted AIF Registration Consultant:

To streamline the SEBI filing and avoid regulatory hurdles, hiring an expert AIF Registration Consultant is highly recommended. - Submit Application on SEBI Portal:

Use the official SEBI platform for AIF Registration Online in India, and keep track of updates or clarifications. - Compliance & Launch:

Post-approval, ensure all fund operations comply with SEBI guidelines before launching.

Why Now Is the Right Time

India is poised to become a global leader in pharma and biotech, fueled by:

- Government initiatives like Make in India and Startup India

- A growing pool of scientific talent

- Increased global interest in Indian healthcare solutions post-COVID

- Regulatory reforms for faster drug approvals and patent protection

AIFs can unlock this sector’s potential, not just for profit but for purpose—investing in innovations that save lives and redefine wellness globally.

Final Thoughts

From genome editing tools to AI-driven drug discovery platforms, the next scientific breakthrough could come from a small Indian lab backed by a visionary fund. Through Online AIF Registration in India, investors can be part of this transformative journey.

If you’re considering launching or investing in an AIF for pharma and biotech, don’t navigate the regulatory maze alone. Connect with an expert AIF Registration Consultant today and take the first step toward funding the future of medicine.